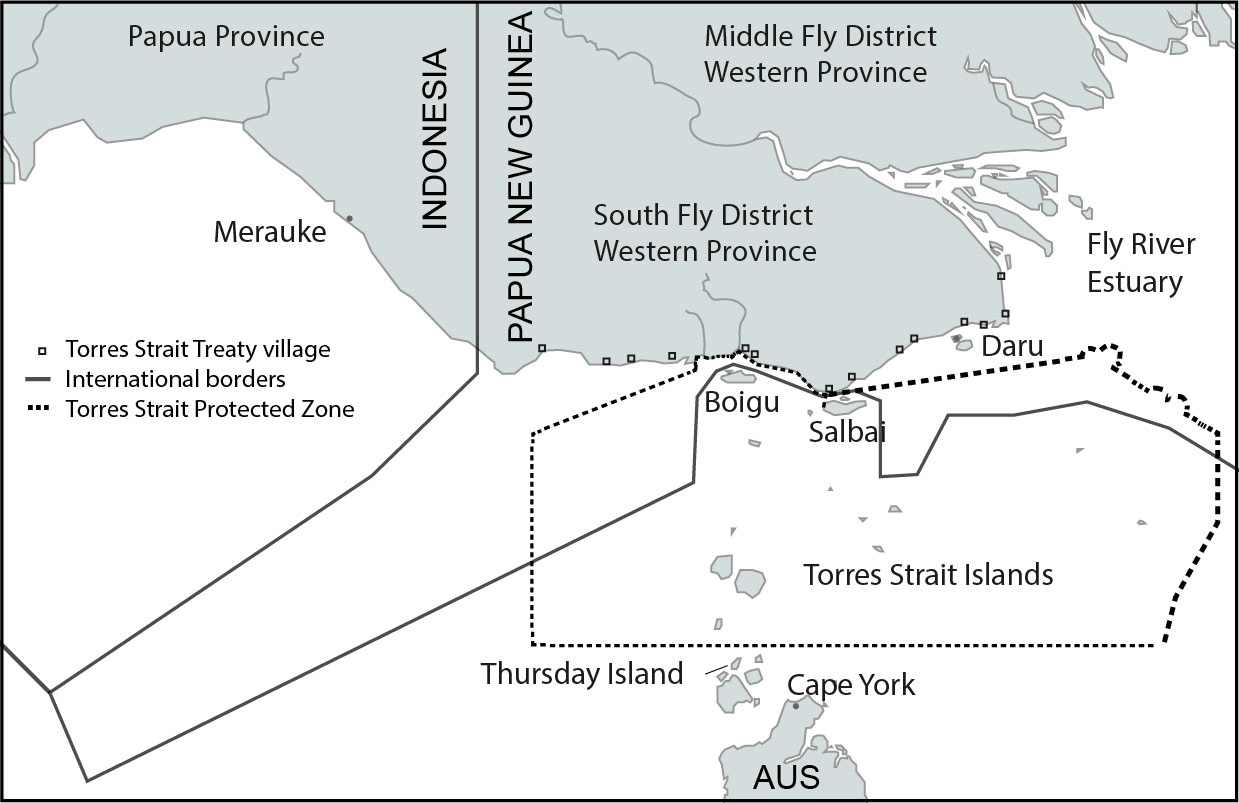

Papua New Guinea (PNG) is now ranked by the World Bank as a lower-middle-income country, largely due to mining-related income. Yet, stepping into remote villages in the South Fly District of Western Province, along the southern border with Australia, one is viscerally confronted with the lack of national expenditure or international finances in the region. Whether understood as corruption, rent-seeking, leakage, profit margins, or the high personnel costs of expatriate aid programs, surprisingly little PNG government, international aid, or global mining investment actually reaches these villages. Rural areas remain starkly disadvantaged compared to their urban counterparts.

The potential for mobile money in rural PNG

Mobile phone connectivity offers an alternative funding modality for PNG Government and aid assistance to reach these remote dwellers. Through what is known as “mobile money,” mobile phones are used to transfer money. Recent research by Tim Grice found that people living in urban centres and rural towns in PNG are already using mobile money, facilitating Person-to-Person (P2P) cashless market transactions. In comparison to carrying around cash, people have security from theft and harassment, especially women (2018). Although P2P transactions are not yet widespread in the South Fly, subscribers already exchange airtime (mobile top up) via the “Credit U Credit Me” Digicel system, a known precursor to uptake of mobile money.

Across the South Fly, there is an existing system of financial transfers to “bricks and mortar” banks and traders. Villagers receive remittances from relatives living in urban centres like Port Moresby, through Post PNG or Bank South Pacific (BSP) branches in Daru. Or relatives in Australia send remittances, via ATMs and stores on the outer Torres Strait Islands. Households affected by the nearby Ok Tedi mine receive Business-to-Person (B2P) electronic payments into family bank accounts as compensation. A fortunate few receive Government-to-Person (G2P) payments for wages as government workers, or pensions as retired public servants. The problem is that these recipients face high transportation costs to the nearest bank, which can exceed one hundred Kina, consuming much if not most of the payment they receive. The potential for mobile money in the South Fly is clear.

Building on these existing payments, there is an unrealised potential for G2P payments to target livelihood development, including women, youth, aged, or community groups. Social payments typically take the form of government benefits, subsidies, and welfare payments. When facilitated through international aid, the practice can be called direct-giving, micro-grants, and cash transfers. Payments are typically conditional on disadvantage (e.g., unemployed, disabled), means testing (e.g., below the poverty line), or behavioural changes (e.g., sending children to school). There are also unconditional payments that trust people to spend the money wisely. While currently not available in PNG, a number of countries are trialling Universal Basic Income (UBI), which avoids any targeting or conditionality whatsoever, making equal payments to everyone, removing tensions arising between the “haves” and “have-nots.”

So how will people spend the money provided? The usual paternalistic concern is that they waste it on cigarettes and alcohol. The limited evidence suggests instead that unconditional cash payments lead to improved food security and wellbeing. However, these studies depend on cultural and social context, and there are few PNG-specific studies. One study into unconditional cash compensation disbursed by Ok Tedi reported a positive impact, including on women and youth. Based on their current expenditure patterns, residents of the South Fly would likely purchase consumables, stockpile some food, travel to market, and pay for school fees and health services.

In addition to paying cash up-front, G2P payments can also be made through retrospective reimbursement of approved expenditures. For example, in India, women are reimbursed for purchasing LPG gas as a cleaner cooking fuel. This national innovation has been made possible through India’s biometric identification system (Aadhaar), which enables targeting of legitimate beneficiaries, including women and the rural poor. Expenditure is reimbursed electronically into the recipient’s bank account.

In the South Fly, the PNG Government already pays villagers for labour-intensive workforce programs (e.g., village roads), as a means of disbursing Local Level Government (LLG) funds. The elected LLG member keeps careful records of days worked, but can then spend months in the district capital of Daru, repeatedly petitioning the District Administrator to release the funds. When the funds finally do arrive, the LLG member makes the journey back home, surrounded by relatives as bodyguards. Their legitimacy as a leader rests on them bring the cash home, and hand delivering payments to each worker. Much of the money is consumed for transportation and accommodation in Daru. Imagine a system of direct electronic payments instead.

A similar situation exists in the New Ireland Province of PNG, with a successful trial of an aged and disability pension. Cash payments were also delivered laboriously by hand, by moving large volumes of cash through the LLG system. For the trial to scale up to a proposed national rollout, an evaluationconcluded that an electronic payment system was needed instead.

Additional investment is needed to overcome identity, security, and logistic challenges

In many South Fly villages, the shared mobile phone is often found dangling from a tree or a window, often in the one place where reception appears intermittently, as observed elsewhere in PNG by David Lipset. The quality of the service is unreliable, as is the availability and quality of the phone devices. Mobile phone coverage in the South Fly has deteriorated, due to the lack of maintenance and coastal corrosion. Work is underway to replace failing towers, with future plans for 3G internet coverage. Additional investment is required, but the cost of installing and maintaining mobile phone infrastructure is low compared to building roads across river deltas and flood-prone savannah. The feasibility of mobile network operators and aid donors increasing capital investment would improve with the injection of G2P payments, as the customer base and the number of calls and transactions grows. Mobile money also offers a general payment platform, which can encourage more B2P transactions, for example, where art shops and dealers purchase local artefacts.

One challenge is the need to establish identity and maintain security, essential precursors for G2P payments. Given the lack of internet coverage, mobile phone customers currently use unique numeric codes via two-way text communications through the USSD platform. Since unique identifiers can be fraudulently registered in the first place, a system for establishing the identity of the subscriber is also important. In PNG, the majority of people do not have any form of written identification, like birth certificates or driver’s licences. Instead, letters from local authority figures, such as a pastor or village court official are used to validate identity. Efforts are underway to issue ID cards through a troubled national identity system, as well as compulsory registration of SIM cards. Despite these challenges, the two major mobile network operators Digicel and B-Mobile already provide mobile money services in partnership with BSP, Westpac, and ANZ. These capabilities could be built on by directing G2P payments through these channels.

Yet another challenge is the need for a network of agents to facilitate cash in-out transactions, especially when the mobile network is not sufficient to underpin full conversion to P2P transactions. Looking internationally, Kenya's mobile money platform M-PESA has been highly successful. It uses an extensive network of cash agents, trade stores, and airtime resellers, with super-agents supervising and providing liquidity to smaller sub-agents. How could this translate to the South Fly, with its sole bank in Daru? Given its significant transportation constraints and low population densities, trade stores outside of Daru are few and far between. Some village households resell mobile credits from tables outside their homes, but they are too small to act as agents. Perhaps then “mobile money agents” could travel to them. In Uganda, the non-profit GiveDirectly incentivised agents to travel to remote villages in return for a transaction fee. Villagers might themselves encourage this, by promoting a local fee structure to attract a visiting agent.

In PNG, there is growing interest in the potential of blockchain and cryptocurrency, which could negate transaction fees and currency exchange costs. Blockchain technology provides secure data storage and records transactions so there is no need for a trusted third party (e.g., a bank) to act as an intermediary. The Bank of PNG and the Australian Department of Foreign Affairs and Trade (DFAT) are currently exploring blockchain’s potential for financial inclusion, and as a land registry for traditional ownership. This includes solar-powered fingerprint readers for identification purposes. But for remote areas like the South Fly, familiarity with mobile money is local Kina seems like a sensible first step, before leapfrogging to blockchain.

With mobile money, opportunities (and risks) abound

Beyond facilitating financial transactions, could mobile money also improve persistent failures in governance and service delivery? There are already initiatives in e-learning, e-service delivery for medical diagnosis and mHealth, and domestic violence call centres. Teacher and health worker absenteeism in villages is often explained by the cost and time involved in travelling to regional centres to receive their pay and purchase commodities. A more vibrant local system of P2P mobile transfers might increase their time spent in their village. Could grassroots organisations also be directly funded to play a role in governance, such as school committees and women’s groups? A local committee could have its own phone.

As with any intervention, there are risks. Any attempts should be trialled on a small scale, and closely evaluated. With social payments in South Africa, mobile money became a vehicle for predatory loan practices. Funding individuals and local groups will fundamentally shift the politics between citizens, leaders, bureaucrats, and international actors, and not necessarily for the better. Bypassing current funding modalities, and their vested patrimonial and transnational interests, will be resisted by those benefitting from the status quo. In PNG, the targeting of particular groups has been observed to intensify rival claims and local disputes, and undermine local committees and informal justice systems. The economic empowerment of women has also been associated with an increased risk of domestic violence.

But there are opportunities also. G2P direct payments would inject much needed finances and services into remote areas, to ameliorate disadvantage and stimulate markets. It also would give citizens and local leaders more “skin in the game,” given that they are largely at the losing end of the distributive politics of public finances. How this would play out will vary by people and place. There will be winners and losers, failures and successes. But when the counterfactual is little of anything reaching remote villages, there must be impetus to balance these risks and to test new opportunities.

PNG is a place of great complexity, with a development landscape littered with failed efforts. The potential for mobile money is often expressed in terms of financial inclusion, but there is also potential to improve development and governance. Direct payments to citizens via mobile money has the potential to disrupt the deeply troubled modalities for traditional public and private finance disbursements in PNG. There are obvious opportunities here for mining companies, in their efforts to disburse royalties and to finance local development. The same can be said for aid assistance, given the difficulty faced in distributing funds through the PNG Government channels, and the high personnel costs of foreign technical assistance.

Professor Mark Moran is the lead Chief Investigator of an Australian Research Council Discovery Grant into the PNG–Australia Borderland. He is also the program director for the Master of Leadership in Global Development at The University of Queensland. Applications for 2019 enrolment are now open!

This article is originally published on the Center for Global Development, where Mark Moran is a Non-Resident Fellow.